Railway developments and regulations in the Middle East

Posted: 14 February 2018 | Gurmeet Kaur - Eversheds Sutherland, Rita Allan - Eversheds Sutherland | No comments yet

Colleagues Gurmeet Kaur (Partner) and Rita Allan (Senior Associate) from global multinational law firm Eversheds Sutherland analyse the progress of the Gulf Railway Project and the key legislation supporting its development.

The history of cross-border rail transport in the Arabian Peninsula can be traced back to the early 20th century when the Hejaz Railway was constructed between 1900-1908 linking Damascus in Syria to Medina in Saudi Arabia1. Although constructed to fulfil the noble objective of facilitating pilgrimages to the holy site of Mecca, the Hejaz Railway’s fate was short-lived as it fell victim to the repercussions of the Arab revolt against the Turkish rule and the First World War. The Hejaz Railway was destroyed and completely abandoned in 1917.

Over a century later, the Gulf Cooperation Council (GCC) is now embarking on the Gulf Railway Project (also known as the GCC Railway Project) – one of the largest contemporary cross-border rail networks in the world. The GCC Railway is intended to connect all the six GCC nations with a railway track running through key cities of each of these nations. A pan-GCC rail network also means that each GCC country would be working individually on its own railway infrastructure.

With a total price projection of over $240 billion2, the GCC Railway Project was initially targeted to be completed in 2018. However, in the aftermath of the recent oil price plunge, completion deadlines have been pushed to 2021. Although authorities remain hopeful that the project will meet its 2021 deadline, completion will ultimately depend on the internal plans of each country and appears challenging.

Country specific developments

United Arab Emirates

The UAE’s rail construction project value accounts for 18 per cent of the total GCC Railway Project value, second only to the project value of the Kingdom of Saudi Arabia3. The UAE’s Etihad Rail network (which, in addition to freight services, will also provide the necessary passenger rail services) has completed 266km of the line, the first phase of its 1,200km-long rail network4. The project objective is to link the seven Emirates of the UAE by freight and passenger rail.

In Abu Dhabi, a Metro and Light Rail Project is currently under consideration. In Dubai, the Red and Green lines of the Dubai Metro have been in operation for a number of years and an expansion of the Red Line to the Dubai Expo 2020 site is currently being constructed. Dubai also successfully launched the Al Sufoh tram network in 2014.

Regulatory framework

The success of any infrastructure project largely depends on the legislative and regulatory framework to enable the successful implementation and operation of the project. In comparison to the rest of the GCC, the UAE has developed a structured regulatory approach towards its rail development projects and has implemented legislation regulating railways and tramways in the Emirate of Dubai.

The key legislation currently regulating the rail sector in Dubai is the Executive Council Resolution No. 1 of 2017 which (amongst other laws) is based on Regulation 5 of 2009, as amended by Regulation 4 of 2012, on the Regulation of Railways in the Emirate of Dubai (Railway Regulation). Other relevant instructions include the Administrative Decision (68) of 2010 Issuing the Implementing By-law of Regulation (5) of 2009 Concerning Railways in the Emirate of Dubai (Administrative Decision), Dubai Executive Council Decision 1 of 2014 on the Regulation of Dubai Tramway, and the Dubai Rail Planning and Design Guidelines (RPDG). While the Railway Regulations repeals Regulation 5 of 2009, the implementing byelaws and resolutions issued under it continues in force, unless they contradict the Railway Regulations. In addition, there are other regulations such as the Dubai Municipality Building Regulations, which need to be complied with for building projects in Dubai. Further, the requirements of utility providers such as the Dubai Electricity and Water Authority need to be considered, to the extent there are interfaces with service lines and utilities on a project.

The Railway Regulation defines railways as ‘a transport system designated for the transportation of passengers and goods on specific tracks. This includes, but is not limited to light and heavy railways’. It sets out the roles of the Roads and Transport Authority (RTA), the Safety and Regulatory Authority (SRA) and the Rail Agency of the RTA (Agency). It designates the RTA as the rail regulator, with duties to plan, design and develop public railway networks including their operation and maintenance in the Emirate of Dubai (including all its free zones). The RTA also regulates the construction, development, operation and maintenance of private rail networks within Dubai.

The SRA is a unit of the RTA which has the responsibility to, among other things, issue Safety Certificates and Operational Safety Certificates, prepare safety conditions and conduct investigations into accidents. The Agency on the other hand has the responsibility for issuing No Objection Certificates (NOCs), proposing the area for the railway’s right of way for public and private railway networks, and prescribing prequalification criteria for contractors, consultants and operators5.

The process for applying for the development permit and obtaining the relevant NOCs is explained in the Administrative Decision and the RPDG and requires developers of rail networks to do the following6:

- At the Pre-Design Phase: Submit a conceptual master plan and a development brief to the RTA in order to obtain the development NOC from the RTA

- At the Design Phase: Appoint an RTA-prequalified designer to prepare the concept design. The developer will be required to make preliminary and detailed design submissions to the RTA in order to obtain the RTA’s approval to proceed to construction

- Prior to the Operations Phase: The owner must obtain a Safety Certificate and the operator must obtain an Operational Safety Certificate in order to carry out railway operations.

Another significant piece of legislation in the UAE is the Federal Decree No. 2 of 2009 on the establishment of the Etihad Rail Company, which will be responsible for the ownership, leasing and rental, purchase and sale of various types of trains, the operation and maintenance thereof and the performance of all rail networks (rail and metro) at the federal level.

Current GCC Railway Project status

Progress

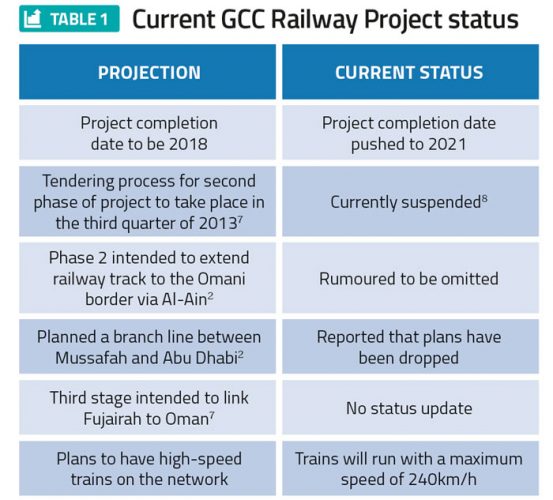

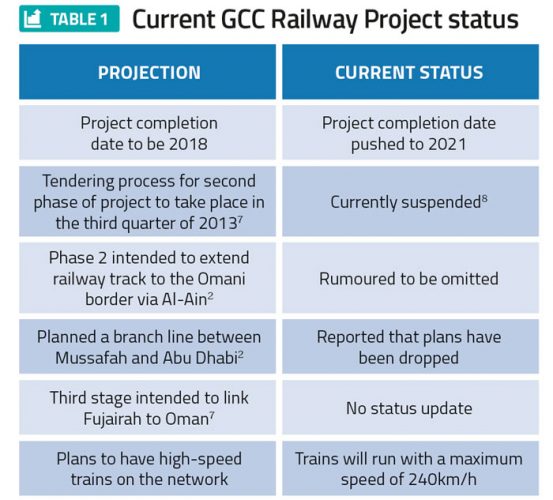

Although the UAE is advanced compared with other GCC countries when it comes to the implementation of its railway projects, there is no doubt that there have been delays compared to its initial projections2. Table 1 gives an overview of the current status verses past projections.

As aforementioned, a large part of the delays can be attributed to plunging oil prices8. In addition, the small size of the UAE does not justify the costs of super-fast trains.

Other GCC countries

Apart from the UAE, at the GCC level, the rail regulations are sparse and not very detailed. Consequently, the region has been inclined to rely on international best practices and standards, particularly in terms of rail safety. The USA in particular is being used as a role model9.

Saudi Arabia

In 2016 the Kingdom of Saudi Arabia (KSA) established a new overall economic development strategy under the umbrella of the Saudi Vision 2030, and the Saudi railway sector in particular is a key focal point for private sector led reforms10. In fact, as of January 2017, KSA had registered the highest rail construction project value of 50 per cent2 of the projected total.

The Solicitation of Expression (EOI) document published by the Saudi Public Transport Authority explains that the following five main segments of railway network are projected for the Kingdom of Saudi Arabia:

- The North-South Railway

- The Riyadh Dammam Line

- The Land Bridge

- Haramain High Speed Rail

- The GCC Line of which the Riyadh Dammam Line and the North South Railway are already operational.

The relevant stakeholders include:

- The UAE’s Ministry of Transport, which is responsible for the transport sector strategy, infrastructure and overall sector development in addition to supervising the independent bodies reporting to it

- The Public Transport Authority, which is in charge of co-ordinating the development of public transport services within and between cities in the Kingdom

- The Saudi Railways Organisation, which currently operates a railway network of approximately 1,400km between the cities of Riyadh and Dammam

- The Saudi Railway Company, a private sector entity owned by the Public Investment Fund which developed and operates the 2,750km North-South Railway network and which in 2016 assumed ownership of the railway tracks for the entire KSA network by way of Royal Decree.

Qatar

Qatar Law No. 1 of 2013 established Qatar Rail. The ‘Qatar Rail Project’ which will be divided into two phases. The first will focus on the Doha Metro and the second on its long-distance rail project which will link its industrial hubs first and then link Qatar to the rest of the GCC9.

Qatar’s Transport and Communications Ministry has also drafted guidelines covering railways to ensure the regulation of railways in Qatar and consistency across its network. These guidelines provide for certifications to be issued by the Ministry at different stages of the project in order to achieve compliance with key objectives of passenger safety, staff , contractors, sub-contractors, third parties and the general public11.

Oman, Kuwait and Bahrain

Oman Global Logistics Group is working on setting up two rail networks internally for the mining sector3 and Oman has projected an investment of $16 billion for trams, long-distance freight and passenger rails.

Kuwait and Bahrain have also projected an investment of $17 billion and $12.9 billion respectively on projects relating to metro, long-distance freight and passenger trains, with Bahrain also investing in high-speed rail12.

The Dubai Metro Red Line: Construction to extend the line is underway

Railway lines beyond the GCC

Some of the GCC nations have also sought to participate in agreements that transcend the GCC borders. For example, Bahrain, Kuwait, Saudi Arabia and the United Arab Emirates have ratified the Agreement on the Arab Mashreq International Railway Network, a railway covering 16 different routes in the Middle East. Similarly, Saudi Arabia, Qatar and the United Arab Emirates are members of the International Union of Railways (UIC) and part of the Strategic Action Plan for the Middle East 2013-2020 aimed at developing an integrated and competitive railway system in the Middle East region. Other members include Turkey, Iran, Iraq, Jordan, Syria and Afghanistan13.

The way forward for Middle East rail

While the Middle East has achieved several milestones in implementing an efficient cross-border railway system, a comprehensive legal framework is necessary in each country and also at the GCC level in order to regulate the individual railway systems and eventually the GCC line. Dubai is currently ahead of the curve with its enactment of the 2009 and then 2017 rail regulations. Successful rail regulation will need to address all aspects of the operation of the railway, the infrastructure that supports it and its interface with others in complex urban environments. The Dubai regulatory framework has provided a good system for regulating rail infrastructure and operations, but there remain clear areas for further improvement – in particular the impact and interface with rail networks in the other Emirates and GCC networks, and developing wide-reaching principles that govern safety and effective operations between the Emirates and wider GCC.

References

- Encyclopaedia Britannica, ‘Hejaz Railway’, britannica.com/topic/Hejaz-Railway, accessed 15 November 2017

- Angel Tesorero, Khaleej Times, ‘GCC rail project to meet 2021 deadline’, khaleejtimes.com/business/gcc-rail-network-target-remains-on-track, accessed 15 November 2017

- Isaac John, Khaleej Times, ‘Why GCC rail is a game-changer’, khaleejtimes.com/news/transport/why-gcc-rail-is-a-game-changer accessed 15 November 2017

- Gulf News, ‘Deadline for GCC rail network pushed back to 2021’, gulfnews.com/news/uae/transport/deadline-for-gcc-rail-network pushed-back-to-2021-1.1959564, accessed 15 November 2017

- Dubai Executive Council Resolution No. (1) of 2017 On the Regulation of Railways in the Emirate of Dubai, Articles 1, 4, 5, 6

- Gurmeet Kaur, Eversheds Sutherland, ‘Middle East- Dubai’s Rail Regulations,’ eversheds-sutherland.com/global/en/what/articles/index.page?ArticleID=en/Transport/Dubai_Rail_Regulations, accessed 15 November 2017

- Abeer Allam, Financial Times, ‘UAE to award contracts for second phase of vast railway network’, ft.com/content/bcaf2b96-f9c1-11e2-b8ef-00144feabdc0, accessed 15 November 2017

- Shereen El Gazzar, The National, ‘Etihad Rail suspends progress on stage two network through Abu Dhabi’, thenational.ae/business/etihad-rail-suspends-progress-on-stage-two-network-through-abu-dhabi-1.205491, accessed 15 November 2017

- Mathew Walker & Ors, Leroy Levy: K & L Gates, King & Spalding, Tracking the changes’, lexismiddleeast.com/doc/2060722_2060726?highlight=%22Railway+tracking+the+changes%22, accessed 15 November 2017

- Public Transport Authority, ‘Railway sector in the Kingdom of Saudi Arabia, Solicitation of Expression of Interest’, saudiarabien.ahk.de/uploads/media/Expression_of_Interest_for_KSA_railway_market_01.pdf, accessed 15 November 2017

- Gulf Times, ‘Qatar: Ministry holds workshop on rail safety guidelines ahead of introduction of new law’, lexismiddleeast.com/doc/2094766_2094782?highlight=qatar+ministry+hold+workshop+on+rail+safety accessed 15 November 2017

- Khaleej Times, ‘$352b worth of railway projects in Middle East’, khaleejtimes.com/nation/transport/352b-worth-of-railway-projects-underway-in-middle-east, accessed 15 November 2017

- International Union of Railways, Strategic Action Plan for UIC Middle-East 2013-2020 (2014), 4-10.

Biographies

Gurmeet Kaur is a Partner in the Energy and Infrastructure Group of Eversheds Sutherland and is Head of the Projects team in the UAE. She has been based in the Middle East region since 2007 and has extensive experience advising on PPP, transport, solar, wind and waste to energy projects in the Middle East. Gurmeet has advised public and private clients on infrastructure projects including advising on structuring, procurement, regulatory, corporate issues and contractual documentation (including FIDIC, Australian Standard forms, EPC, EPCM, BOO, BOOT, DBO and O&M). She has also advised the RTA on various projects.

Rita Allan is a Senior Associate in the Energy and Infrastructure Group of Eversheds Sutherland. Her practice focuses in engineering, procurement and construction matters in a wide range of sectors, with a focus on energy and renewables. In addition to her conventional power project work, Rita has significant experience advising major importers of natural gas on operational matters and disputes arising under long-term gas supply agreements and operational contracts. She has also frequently advised on construction and infrastructure projects procured by way of PPP/ PFI arrangements. Rita is familiar with the most commonly used standard for construction contracts (such as FIDIC, JCT, NEC, IChemE, NCS) and has acted for lenders, owners and contractor clients worldwide.

Issue

Related topics

Infrastructure Developments, Regulation & Legislation, Route Development, Track Construction