Essential steps of CD Cargo for improved performance

Posted: 28 May 2008 | | No comments yet

The newly-founded, independent organisation, CD Cargo, intends to concentrate on renewing its rolling-stock, supporting the construction of logistics centres and improving the quality of the services it provides to its customers. In an interview for Global Railway Review, Josef Bazala, Chairman of the Board of Directors and Director General of CvD Cargo, claims “Only with this strategy will we succeed in continuing the growth tempo in carriage established in recent years and reinforcing our share of the transportation market.”

The newly-founded, independent organisation, CD Cargo, intends to concentrate on renewing its rolling-stock, supporting the construction of logistics centres and improving the quality of the services it provides to its customers. In an interview for Global Railway Review, Josef Bazala, Chairman of the Board of Directors and Director General of CvD Cargo, claims “Only with this strategy will we succeed in continuing the growth tempo in carriage established in recent years and reinforcing our share of the transportation market.”

The newly-founded, independent organisation, CD Cargo, intends to concentrate on renewing its rolling-stock, supporting the construction of logistics centres and improving the quality of the services it provides to its customers. In an interview for Global Railway Review, Josef Bazala, Chairman of the Board of Directors and Director General of CvD Cargo, claims “Only with this strategy will we succeed in continuing the growth tempo in carriage established in recent years and reinforcing our share of the transportation market.”

As an informed manager, knowledgeable in the context of Czech rail, could you give an overview of the railway system, its history and its institutions in the Czech Republic?

The Czech railway network is made up of approximately 2,700 railway stations and stops that connect some 9,500km of track – one third of which is electrified. Therefore, the Czech rail network, with its 120km of track per thousand square kilometres, is at the very summit of countries with the highest density of railway tracks in Europe. Czech Railways, as a carrier, is therefore able to build on a fine, 170-year tradition of rail transport in the Czech lands. Of course, this brings with it advantages and disadvantages. The railway environment here is conservative and is only able to accept modern changes with great caution. Czech railways enjoyed their golden age in the second half of the 20th century. However, the end of the socialist era saw a considerable lack of finance for maintenance, never mind development. They then began to lose their customers during the economic boom of the 90s and also their position on the market following the enormous expansion of road transport in both segments – passenger and freight transport. The state-run Czech Railways was transformed at the beginning of 2000.

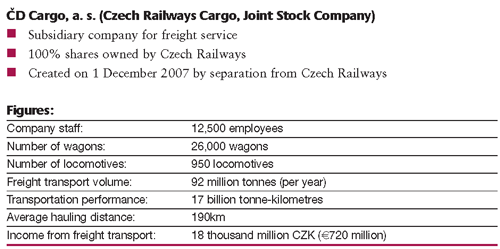

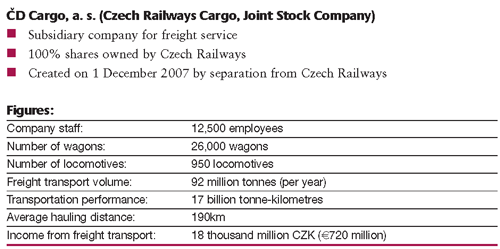

Ceské dráhy, a. s. (which translates as Czech Railways, Joint Stock Company) was newly-founded in January 2003 on the basis of Act No. 77/2002 Coll. on the Czech Railways Joint Stock Company as one of two transportation successors to the former Czech Railways state organisation. The second of these successor companies is Správa železniční dopravní cesty (the Railway Infrastructure Administration), a state organisation which fulfils the role of infrastructure manager. The Czech state is the owner of Czech Railways as its 100% shareholder. The principal subject of business activity at Czech Railways is the operation of rail passenger transport. Freight transport was separated from Czech Railways in December 2007 as the independent joint stock company CD Cargo, which is now the subsidiary company of Czech Railways, the 100% owner.

You spent the past five years as a Senior Manager at Czech Railways. How do you now assess this period? What were your successes and what would you consider was less successful?

Because I have devoted myself to the railways my whole life, it was a massive challenge for me after my return to Czech Railways from the private sector in 2003, to finally initiate the changes that would lead to the improvement of the entire company, until that time a company with a fairly poor reputation and loss-making management. Our reforms were built on a number of pillars. First of all, it was important to introduce a number of programmes to save costs, with the aim of ensuring financial stability for the company. We also changed several company procedures and some activities were centralised, for example all purchases and internal stocking. Outsourcing was then introduced for other activities that had been performed ineffectively. We understandably had to reduce the number of employees and introduce new technology, after which time work productivity increased by 25%. One important factor was that the changes we introduced were also seen in operation and that customers could assess them too. For this reason, we launched a number of new projects involving the updating of our railway carriages – we introduced high-speed Pendolino trains to international links from Prague to Bratislava and Vienna and began revitalisation projects on more than one hundred train stations based on cooperation with partners.

Then in 2004, I initiated strategic decisions on restructuring Czech Railways as a holding organisation, as the ‘Czech Railways Group’. The three years that followed saw the successive breakaway of all servicing and additional activities (for example, research work, telecommunications and informatics, vehicle repairs) as subsidiary companies. Clear rules were introduced for the companies and most importantly a new business policy that concentrated on the needs of the customers. These independent subsidiaries gradually began winning contracts outwith the Czech Railways Group, stabilised internally and on their own markets relatively quickly and gradually all moved into the black. The culmination of this was that Czech Railways as a whole ended the year 2007 with a profit of 53 million crowns (€2.1 million), the first time the company had achieved a profit (with losses running into several thousand million crowns fairly common until that time). So, in this regard, I am absolutely convinced that the entire reform process was a success.

This process of restructuring culminated in December 2007 with the second stage; in other words the breakaway of a core business – freight transport – to become an independent subsidiary: CD Cargo, a. s. The final stage of this restructuring, the independence of passenger transport, is currently at the preparation stage.

You have been the boss of CD Cargo since December 2007. Could you explain how the new company was born and the prospects and plans it has? Or what, if anything, does it fear?

CD Cargo was founded on 1 December 2007 by government resolution by transferring a core area of business activity at Czech Railways to a subsidiary company. This involved the non-capital contribution of part of the business of Czech Railways. According to expert valuation, the assets passed to the new joint stock company have a value of approximately 9 thousand million crowns (€360 million) and include property for the maintenance and repair of rail vehicles and the entire rolling-stock itself. CD Cargo now owns 950 locomotives and approximately 26 thousand freight cars, whilst some 12,500 employees have moved from the parent company to CD Cargo. The whole of this project, the foundation of CD Cargo, was carefully prepared for over a year. The company works properly in operating activity and it now only remains to “fine tune” a few details, for example the setting of the basic parameters of relations within the entire Czech Railways Group so that practical synergetic effects are maintained.

The new organisation, CD Cargo, was created with a new, modern logo, but obviously draws on its rich traditions and experience. It is our intention to build a modern, dynamic company that is flexible to its customers, open to cooperation, active in international projects and obviously successful and profitable. Independence from Czech Railways has meant an important change – the elimination of so-called cross financing. Every year prior to this, freight transport had to subsidise loss-making passenger transport, meaning that it was lacking the funds for its own development. The result is a neglected technological base and rolling-stock and this is what we are changing now. In consequence of this change, we are increasing the resources available for investment in freight transport, mainly in expanding the capacities of the freight rolling-stock. We plan purchases, reconstruction and modernisation steps for our vehicles in 2008 and 2009 to a total value of 3 thousand million crowns (€120 million).

We expect to achieve challenging targets in the very first year of the company’s existence and are counting on a growth of carriage and revenues of approximately 4%. If everything is as successful as we set out in our ambitious business plan, we can achieve a profit of approximately 1.1 thousand million crowns (€44 million). However, I would like to stress that our main target is to reinforce the position of rail carriage on the domestic and foreign transportation markets. We want to prosper as a company and re-invest the profit achieved in further development.

With the development of the liberalisation of the railway market in the Czech Republic, how strong is the competition to CD Cargo?

The Czech Republic has fully adopted the “acquis communautaire” valid among the original EU countries in the area of rail transport. The conditions for the liberalisation of this industry were actually created back in 1995. There are now several dozen organisations that operate rail freight transport in the Czech Republic. However, these were established on the market more than ten years ago and gradually took 10% of the volume of carried goods from Czech Railways. The situation has now been consolidated in this regard. CD Cargo certainly does not have a dominant position today. It is also clear that the transportation market is ruled by road transport and that the rail sector finds itself in a far weaker position. In general, we can say that the transportation market is a market environment with strong competition.

With the advancing liberalisation of the European rail market, CD Cargo intends to provide more of its services outwith the Czech Republic, either directly or in cooperation with other carriers or in the form of multinational alliances. It is in this sense that discussions are currently ongoing between the Czech and Slovak governments on the possibility of merging the Czech and Slovak versions of Cargo. Apart from this, CD Cargo is involved in a wide range of European Union projects. From a European perspective, CD Cargo is the fifth largest rail carrier in the European Union according to performance indicators.

In your opinion, what does the situation of the Czech transportation market currently look like and what are the results of the battle with road transport?

If we are talking about our competition, then we are talking mainly about road transportation. The rail sector has a share of approximately 22% on the Czech market, whereas the road sector covers 3/4 of freight carriage. On the one hand, this is still a very good result in comparison with development in other European countries, where the percentage of rail carriage is under 10%. However, the majority of transport experts are convinced that the percentage held by the rail sector on our transportation market will fall further and will come closer to the European averages. We would like to prevent this and are convinced that we even have the chance of slightly increasing our percentage.

We currently transport approximately 90 million tonnes of goods, whereas road haulage carries around 430 million tonnes. However, the capacity of the railway network is currently limited. Under the current infrastructure conditions we can only hope to grow to approximately 120 million tonnes. After the completion of the main rail corridors and infrastructure in the Czech Republic, which will take another five to six years, the volume of commodities carried by rail could reach up to 140 or 150 million tonnes, meaning that the rail sector’s share of the transportation market could reach up to 30%.

Has the Czech Republic witnessed a harmonisation of conditions for the rail and road sectors in terms of applying charges to the use of the road infrastructure?

Yes. On the one hand we certainly welcomed the introduction of toll collection on Czech roads last year, but on the other hand we are somewhat disappointed by the fact that the method of collecting tolls is still not fair from our perspective as rail carriers. If we compare the total amounts collected in charges during the past year in the individual sectors of freight transport (rail: 4.5 thousand million crowns, road: 5.5 thousand million crowns) and relate these figures to output in tonne-kilometres (where road transport achieves approximately four times the output of rail transport), we discover that road transport pays only approximately 30% of the amount paid by rail transport for using the infrastructure. What is more, in contrast to the road sector, an infrastructure charge is paid for the whole network in the railway sector. This is not to mention the issue of so-called externalities; in other words external costs. For this reason we would welcome at least a gradual convergence of the structures of both systems for collecting these charges as soon as possible.

What instruments do you plan to use to increase your share on the transportation market?

Mainly developmental programmes, of course. We aim to concentrate on updating the rolling-stock, supporting the construction of logistics centres that are connected to the railways and improving the quality of the services we provide to our customers. Only using this strategy will we be able to continue the tempo of growth in carriage established in forthcoming years, when our output has risen by approximately 4% per annum. We plan a more expansive renewal of the rolling-stock, whereby we have to flexibly adapt the structure of wagons we offer to suit customer demand. This currently concerns container cars, for example.

We currently have a number of plans in the sphere of building logistics centres. The centre in Lovosice is at the most advanced stage, where the basic terminal is already operational and trains already provide connections to German ports, for example. Other locations are found in Brno and the Ostrava area, where we are preparing a logistics project for the Hyundai car plant in Nošovice. In contrast to the TPCA car plant in the Kolín district, the local internal sidings should be built more generously so that it is possible to transport not only cars, but the majority of components required for their manufacture. Otherwise we are also trying to initiate the construction of sidings to factories. Various programmes, including government programmes, are in existence for their construction. The financing of these should therefore be a sort of mix: the state ought to pay for the rail infrastructure and whoever provides the storage areas, buildings and carriage mechanisation has to pay for constructing of these services. In other words, our company as well.

What are your visions for company development and what do you see is the future of CD Cargo?

We want to concentrate more on the carriage of commodities that require greater participation from the perspective of organisation and logistics, which is more complicated but charges more. This form of carriage was and is to this day the domain of road transport. We want to transport the traditional commodities of rail carriage, such as bulk commodities, building materials and wood, as well as components for the automotive industry and palette goods, and to increase the volume of container carriage.

Another essential step is to broaden the spectrum of services for customers. By this I mean ensuring related services. Logistics terminals should in future also serve as distribution warehouses, which are often an extension of production plants at the moment. Companies which deal with logistics then provide distribution from these warehouses for a number of companies. And that is our aim – to assert ourselves more on this market. The market in the Czech Republic is growing in this sector. The automotive industry, i.e. the transportation of components to factories and the dispatch of finished products – cars for customers, holds a major share in first position.

We are also now concentrating more on “just-in-time” carriage. Beforehand, this “timing of logistics”, i.e. storage and distribution, was performed by the companies themselves at their own plants. Now the trend is to move these activities from the plant and transfer them to logistics companies, which ensure distribution from their own warehouses for a number of customers. We intend to win a greater share of customers and to offer our existing customers added value through support for the construction of logistics terminals and the connection of distribution warehouses to the railways, as well as cooperation with road haulers.

Our strategy generally involves the focus on our customer, reliability, the development of logistics and related services and greater cooperation with partners – with national and other carriers, partners from the road transport sector and logistics partners. The logistics companies create logistics chains and we need to be an active part of this. For this reason, CD Cargo holds shares in certain logistics companies, for example BohemiaKombi or CD Logistics. We are aware that if we want to succeed, we must be involved in this form of cooperation.

Figure 1: Overview