Railway electrification market remains buoyant

Posted: 4 April 2010 | | No comments yet

Railway electrification captures the zeitgeist of the 2010s. It addresses two of the world’s central concerns at this time: oil availability and carbon emissions. So despite pressures on public finances as a result of the economic recession, railway electrification continues to prove popular in Europe.

‘Peak oil’, the point in time when the maximum rate of global petroleum extraction is reached, after which the rate of production enters terminal decline, may already have been passed. So analysts fear there will be less and less oil available, and what there is will be more and more expensive.

‘Peak oil’, the point in time when the maximum rate of global petroleum extraction is reached, after which the rate of production enters terminal decline, may already have been passed. So analysts fear there will be less and less oil available, and what there is will be more and more expensive. Already, rolling stock leasing companies are shying away from financing diesel trains: with trains having a nominal 30-year life, they wonder if there will be any fuel around in 2040 to pump into the tanks of diesel multiple-units and locomotives.

On top of this come worries about carbon emissions and global warming. Diesel railway vehicles are responsible for just a small proportion of total carbon emissions – getting rid of them by railway electrification would be only a small win in the fight against global warming. The real score would come from modal shift, as cars and aeroplanes account for a large part of the carbon emissions total. Shifting passengers and freight on to electric trains, where the energy can be sourced from carbon-friendly generators such as renewables and nuclear, would make the overall transport system greener.

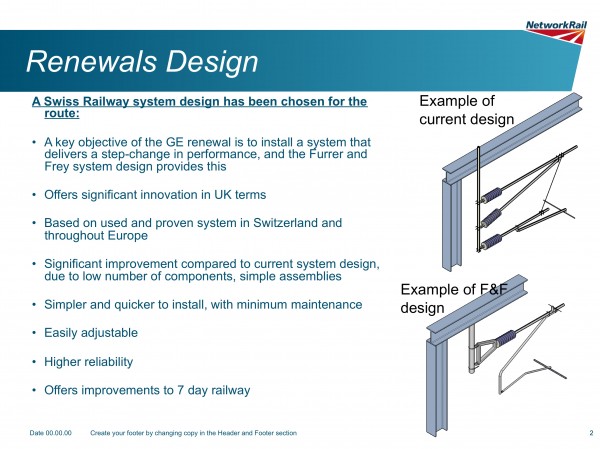

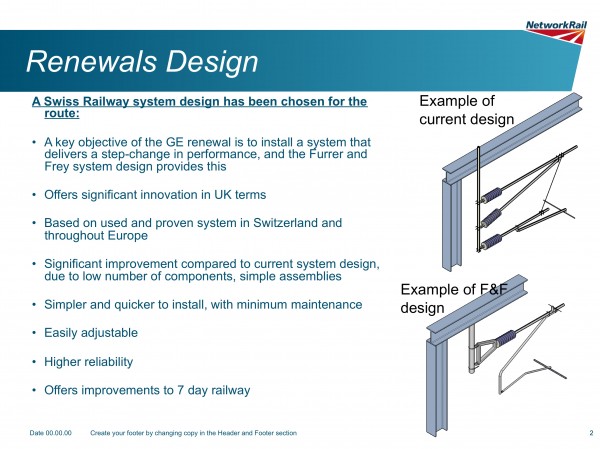

The Furrer+Frey design of electrification equipment used on the line out of London Liverpool Street station is lighter and more efficient than the design it replaces

Electric trains have historically been cleaner, quieter and quicker than diesels, although these advantages have become less clear-cut than they used to be following advances in diesel technology. Indeed, General Electric Transportation Systems argues that its new locomotive aimed at the European market, the Class 70 purchased by Freightliner in the UK, is so fuel-efficient that it is ‘greener’ than electric locomotives powered by dirty coal-fired power stations. If railway electrification is to be part of a ‘green revolution’, electric trains have to be powered with electricity sourced from clean methods of generation.

On top of these wider environmental concerns come the business issues that have conventionally driven electrification schemes. On densely-trafficked lines, the operational costs of running electric trains can be lower than the operational cost incurred when running the same load of traffic with diesels. However, operational costs have to be lower by a considerable margin to offset the capital costs of electrification, and sometimes electrification schemes can struggle to find a financial justification – especially when the low-hanging fruit has already been picked, and all the most important lines are wired already. This is not the case in the United Kingdom, one of the most promising markets for electrification, where several main line projects have financial as well as social justification.

UK at the forefront

In past decades, the UK has taken a more sceptical view of the value of electrification than countries on the European mainland. Consequently, just a third of the UK’s rail network is electrified, compared to over half in France and Germany. At the other end of the scale is Switzerland, which in the last century took a decision to harness the power of hydro energy in the Alps for the sake of national security, and consequently boasts a 100% electrified railway network. Overall, according to analysts Frost & Sullivan, the 25 European states have over 230,000 kilometres of mainline network of which only 52% is currently electrified.

Thus the UK is playing catch-up and last year the British transport secretary, Andrew Adonis, announced that the Great Western main line from London to Bristol and Cardiff, as well as lines radiating from Manchester and Liverpool in the north west of England, would be electrified in the next Network Rail control period from 2015 onwards. Network Rail intends to spend the time between now and then investigating ways of electrifying lines on a ‘production line’ basis and procuring high output equipment for achieving this. The aim is that a rolling programme of electrification will allow NR to achieve high productivity and economies of scale.

A pilot project is already underway north of the border in Scotland, where the devolved government is committed to railway electrification. Track is currently being relaid on a long-closed link across the centre of the country, between Airdrie and Bathgate, that will establish a fourth rail line between Scotland’s two largest cities, Edinburgh and Glasgow. The A2B project, as it is known, will be fully electrified on the 25kV AC overhead system when it opens in December this year.

The Scottish government intends to follow this project with a programme of electrification in the Scottish lowlands, wiring the principal route between Glasgow and Edinburgh via Falkirk and also branches to Alloa and Dunblane. The British plans for electrification are highlighting where the costs are in railway modernisation. Placing poles in the ground and stringing wires above the tracks is not an expensive operation, especially if high productivity machines are used, and electrification does not seem to have been subject to the rapid cost inflation that has affected other infrastructure sectors.

It is where the wiring comes as part of a package of modernisation, as it often does, that the costs seem large. Thus the Great Western main line electrification will come as part of a wider route modernisation project, that will see permanent way renewed (it was last comprehensively treated in the 1970s prior to the introduction of the 200km/h diesel trains that are still at work on the route), and the introduction of the European Train Control System. Add to these the procurement of a new fleet of electric trains to work the newly-wired routes and a sizeable bill results. Other countries besides the UK are adding to their length of electrified main lines. For example France, under the State Strategic Plans (CPER 2007-2013), is electrifying a further 600km of its mainline network.

High-speed lines

One of the most promising markets for suppliers of electrification equipment is the high-speed sector. Purpose-built high-speed lines are conventionally electrified on high-voltage systems, and Europe has not lost its appetite for high-speed expansion.

Spain in particular is building apace, complementing lines from Madrid to Seville and Barcelona with new routes to the north east and across the French border. Germany and France are adding to their already extensive high-speed networks, and the UK is assessing the case for a High Speed 2 from London to the Midlands and the North to complement the High Speed 1 line from the Channel Tunnel to London.

This building boom is coming to an end in some countries. Belgium views its high-speed network as complete now, having built lines linking Brussels to France, Germany and the Netherlands. Italy, too, is well on the way to completing the ‘T’-shaped high-speed system that will form the backbone of the country’s rail network. Overall, analysts Frost & Sullivan expect about 9,570 kilometres of high-speed electrification projects to be commissioned by 2015.

Re-electrification

Another market segment that will boost equipment demand is renewal of worn-out equipment on already-electrified lines. A case in point is the renewal of the overhead wiring on the line out of London’s Liverpool Street station, where the old catenary dating from the 1940s is life-expired.

Infrastructure owner, Network Rail, is reusing the overhead stanchions where possible, meaning only about 10% of the overhead structures are new. But the small electrification equipment and cable are being completely renewed, with a light and efficient system from Furrer+Frey of Switzerland.

This is Furrer+Frey’s first entry into the UK market, and the company hopes to build on success on the Liverpool Street line with further orders when the UK starts its big mainline electrification project in 2015. Network Rail says the Swiss system is simpler and quicker to install than historic systems, with minimum maintenance and high reliability. Importantly, the Furrer+Frey system features an auto-tensioning device that will adjust the cable tension depending on the ambient temperature. This should end the problem of dewirements in the summer heat that has bedevilled the existing system. High reliability will be all-important on this line in 2012, as it goes through Stratford where the London Olympics will be held in that year.

Feeding equipment

In addition to new cable and small electrification components, a sizeable market exists for feeder equipment. On the West Coast main line in the UK for example, 50kV autotransformer equipment from ABB has been installed as part of the comprehensive modernisation of the route. The autotransformer system is commonly used on high-speed lines on the European mainland and has been selected for the West Coast route as it will support a higher density of traffic than a conventional system.

In Germany, Siemens Mobility has recently received an order from DB Energie to upgrade the electricity supply equipment on railway lines in the federal states of Mecklenburg-Vorpommern and Brandenburg. Two 15 MW Sitras SFC plus type traction converter units each are to be set up in Adamsdorf, Cottbus, Frankfurt (Oder) and Rostock. The DB Energie order includes the three-phase transformers and output reactors, the high-voltage switchgear and the newly developed Sitras ASG 15 type air-insulated medium-voltage switchgear. In addition, Siemens will supply the control equipment and protection devices.

Since Deutsche Bahn does not have its own high-voltage network between Rostock and Cottbus, the energy required for traction power supply comes from the public grid via a decentralised supply. The converters in Rostock and Adamsdorf are expected be in operation by the beginning of 2012, while those in Cottbus and Frankfurt (Oder) will follow one year later. They will replace the rotary converters there, which have been used up till now to convert the three-phase current from the public grid (50 Hertz) into a single-phase traction current (16.7 Hertz).

Siemens’ multilevel technology enables the single-phase traction power to be supplied directly into the overhead contact line. This can be done without the need for any traction transformer due to the high output voltage of the Siemens converter. The converter is then decoupled from the traction power supply by means of a reactor. Customarily available frequency converters, on the other hand, require two transformers to do this.

This German order comes shortly after another from Sweden. Banverket, the Swedish Rail Administration, has given Siemens an order to set up five converters for a combined rating of about 130 MW in the Greater Stockholm area.