Surge’s rail-first approach aims to bring affordable internet to Indonesia

Posted: 27 October 2025 | Ian Betteridge - Global Railway Review | No comments yet

Surge is using a “railway-first” fibre network strategy to transform Indonesia’s broadband market. By building along railway corridors, partnering with the national rail operator, Huawei, and local ISPs, the company aims to deliver faster, more affordable internet while advancing national goals for digital inclusion and education.

Indonesia’s broadband market has long been defined by low fixed-line penetration, modest average speeds and prices that are high relative to incomes. Surge (PT Solusi Sinergi Digital Tbk), led by chief executive Yune Marketatmo, believes it has found a way to change that trajectory by building fibre along railway corridors, aligning commercial incentives with the state rail operator and partnering with technology providers to accelerate deployment.

Affordable, faster internet can materially benefit education, small and medium businesses, and the wider economy.”

“We want to serve the people of Indonesia,” Marketatmo says. “Affordable, faster internet can materially benefit education, small and medium businesses, and the wider economy.”

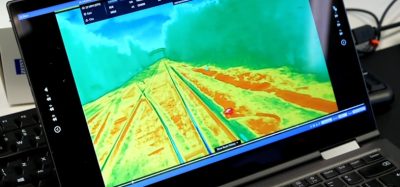

In conversation at Huawei Connect 2025, he set out a strategy that is both pragmatic and ambitious. Rather than contesting every street permit and right-of-way one neighbourhood at a time, Surge began by laying backbone fibre on railway land, where security is tight and access is centrally governed. “The key idea was to lay fibre along railway corridors first,” he says. That foundation now underpins an access network that extends out from the tracks in measured increments, staying close to dense demand and controlling costs through discipline rather than sprawl.

The railway advantage is threefold. Time and cost are improved because wayleaves and community permissions are managed in one relationship, avoiding thousands of piecemeal approvals. Security is stronger on railway property, reducing theft and accidental cuts that often plague road builds. “Incidents are about ten times lower than when I worked in traditional deployments,” Marketatmo notes. And proximity to demand is built in: in Java, one kilometre to either side of the track reaches millions of homes, with ten kilometres covering a large share of the island’s households. The result is a lower incident rate and faster scale-up than traditional street-by-street approaches.

Partnership sits at the heart of the model. With the rail operator, Surge uses a revenue-sharing agreement instead of fixed site rental. “We use a revenue‑sharing model rather than fixed OPEX rent. When our revenue increases, their share increases; when it decreases, it decreases,” he says. This aligns incentives and, in practice, encourages collaboration over annual rent demands. Surge also provides benefits beyond cash. It supports the operator with software for ticketing, offers free high-speed Wi‑Fi to passengers that can be monetised through captive portals, and grants capacity for internal IT and signalling.

Technology partnerships are equally central. Surge has signed a strategic collaboration with Huawei that Marketatmo characterises as a partnership rather than a conventional vendor relationship. “We’re first movers on an affordable product in Indonesia with Huawei’s support,” he says. The practical upshot is access to mature platforms, global best practice and AI-enabled operations tools without lengthy in-house development cycles.

The commercial outcomes described are striking. Surge reports year-on-year revenue growth of around 66 per cent and an EBITDA margin close to 79 per cent. Market valuation has also increased significantly over the past year. While these figures are company-reported, they suggest that affordable pricing and strong unit economics are not mutually exclusive when network build is highly targeted and partnerships carry part of the load.

Success is measured beyond our company… raise penetration and speeds, enable education, and empower SMEs.”

Crucially, the strategy extends beyond the usual corporate performance metrics. Marketatmo articulates a national mission: to raise fixed broadband penetration from roughly 15 per cent towards 50 to 60 per cent, to lift average speeds, and to use connectivity as a platform for education and small business growth. A smart education pilot in West Kalimantan is planned, aiming to combine connectivity with platforms that enable teaching from top universities and adaptive, AI-supported learning.

For small and medium enterprises, the emphasis is on practical tools that help with pricing, accounting and access to finance, recognising that digital basics can be transformative when margins are thin and volatility is high. “Success is measured beyond our company,” he says. “Raise penetration and speeds, enable education, and empower SMEs.”

Surge also wants to collaborate with Indonesia’s long tail of local ISPs rather than supplant them. The company’s model shares revenue and leverages local partners’ on-the-ground strengths in sales, community permitting and troubleshooting, while Surge provides technology, standard operating procedures and materials. Training centres in railway stations make it easier and cheaper to upskill partners, and external relationships bring further capability. NTT-East has taken a 49 per cent stake in Weave, a Surge subsidiary, providing process rigour and training support, and Huawei has committed to contribute expertise to the training centres. “Rather than displace small ISPs, we partner through variable revenue sharing,” Marketatmo says.

There are challenges. Busy commuter lines constrain work windows to overnight periods, and any plan that seeks to change national penetration will need consistent execution across islands with very different geographies and economics. But the approach is notably coherent: start on secure, centralised corridors; expand in layers near the tracks; align incentives with core partners; and import mature technology where it reduces risk and accelerates outcomes.

Marketatmo’s framing is deliberately expansive. The target is not simply a larger network, but a measurable contribution to Indonesia’s economic and social progress. If the company can sustain its current growth while pushing penetration higher and prices lower, the model could become a template for infrastructure deployment in markets where permits, security and demand density have long frustrated investment. For now, the combination of rail-first engineering and partnership‑first commercial design is giving Surge momentum in one of South‑East Asia’s most demanding broadband markets. Perhaps there are lessons here for rail companies globally, too.

Surge accelerates affordable broadband with 1.4 GHz spectrum win

Surge, through its subsidiary PT Telemedia Komunikasi Pratama, has secured the 1.4 GHz N50 80Mhz spectrum in the recent Komdigi (Kementerian Komunikasi dan Digital) spectrum auction.

With the 1.4 GHz spectrum, we can reach millions of new users faster.”

Having this spectrum gives Surge a strong foundation to scale quickly while supporting government initiatives for digital inclusion. From a consumer standpoint, the entry of new players like Surge increases competition — meaning better access, lower prices, and improved service quality. Ultimately, this aligns with our vision to make digital connectivity a fundamental right, not a privilege.

This win is a major step forward in Surge’s mission to deliver inclusive and affordable internet access for all Indonesians. “With the 1.4 GHz spectrum, we can reach millions of new users faster,” Marketatmo added. The spectrum allows Surge to deploy 5G-based Fixed Wireless Access (FWA) that complements our FTTH networks, creating a strong and efficient hybrid model for broadband expansion.

Global Railway Review Autumn/ Winter Issue 2025

Welcome to 2025’s Autumn/ Winter issue of Global Railway Review!

The dynamism of our sector has never been more apparent, driven by technological leaps, evolving societal demands, and an urgent global imperative for sustainable solutions.

>>> Read the issue in full now! <<<

Related topics

5G, Artificial Intelligence (AI), Digitalisation, Electrification & Cabling, Funding & Finance, Infrastructure Developments, Internet of Things (IoT), Operational Performance, Passenger Experience/Satisfaction, Procurement, Security & Crime Management, Sustainability/Decarbonisation, Technology & Software, Training & Development, Wi-Fi